Credit Guide

Build Your Credit. Raise Your Credit Score Fast!

Your credit score matters! The FICO Score is a simplified score ranging from 300 to 850 that lenders use to determine creditworthiness.

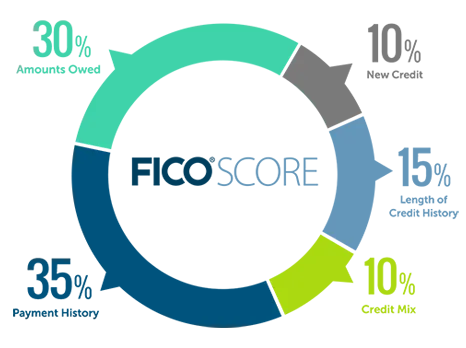

It's calculated using five different components of your credit history:

35% = Paying Your Bills On Time

30% = Your Credit Card Utilization

15% = How Long You Had Credit

10% = Types of Credit

10% = Inquiries

So, if you're trying to guarantee that your credit score improves in the next 60 days, we need to add positive credit history with big limits!

We prepared several recommended options for you, each has different amounts to start, and when you get a much larger limit, it will help your credit score faster.

Remember, 30% of your credit score is your credit utilization. Bigger limits = Bigger score increase.

The more the better, but if you can only do one at a time, it's OK too. The goal is to get them as soon as you can to maximize the benefit of a credit limit increase.

The goal is to boost your credit score in the next 60 days with few simple actions!

#1 Get a copy of All Your 3 Credit Reports and Score

Get Credit Monitoring and Your 3B Credit Reports & Scores! Membership Snapshot:

🌟 ScoreTracker

🌟 ScoreBuilder®

🌟 ScoreBoost™

🌟 Money Manager

🌟 Smart Credit Report®

🌟 $1 Million Fraud Insurance

🌟 PrivacyMaster®

Plus Your Money, Privacy & Insurance

#1 Best Recommended!

Helps you build credit for any stage in your financial journey. No credit score is needed to get started! No Hard Pull. There is no hard credit pull when you open your account.

Strong Credit Opens Doors.

✅ Helps you build credit for any stage in your financial journey. No credit score is needed to get started!

✅ Instantly build revolving credit with no minimum monthly payment requirement. It can help improve credit card utilization.

✅ Build installment credit and your savings with a low fixed monthly payment on a CreditStrong credit builder loan.

✅ When you have the cash, but not the credit, build BIG credit with the largest and longest credit builder accounts in the nation.

Build credit with Kikoff.

✅ Meant to help those who need to build a credit history from square one, Kikoff is a no-cost solution that offers users a maximum line of credit of $500.

✅ The main benefit of the San Francisco-based company’s card is that it helps those who don’t want to plunk down any cash for a secured card and thus have no other way of beginning the credit-building journey.

✅ There are no fees or interest, but there is a big catch: users can only “spend” the money on the company’s site-based store.

✅ Kikoff reports to the major credit bureaus, and there are no credit checks. The card only comes with $500 on it, no more and no less.

A new way to build credit

Online banking made easy. Your search for an online bank account is over: when you bank through Chime, expect no monthly service fees, no minimums, and no hassle.

✅ Start building credit for free.

✅ Start building credit safely

✅ Start building credit on everyday purchases

✅ Start building credit for a better future

The credit card of tomorrow.

Available for Anyone and Everyone! No Credit Score? No Problem!

This is Perfect is You Are you looking for...

✅ A credit card that doesn't require credit history

✅ Start building credit safelyA credit card with no fees or interest rate (APR)

✅ Expedited and automated payment options to improve your credit quickly

✅ Control of your finances

✅ A product focused on being inclusive

FIND YOUR BEST OFFER IN 3 EASY STEPS!

The best Credit Card Navigator. This is a free service and an information resource for credit cards and financial products and services available for consumers. You can search for credit cards that offer zero-percent APR balance transfers, great cashback offers, membership reward points, frequent flyer miles, and more. You can read credit card reviews, see side-by-side comparisons between competing cards, and find out which cards are the best match for your credit history.

They are constantly on the lookout for the hottest offers to save our customers money and give you rewards.

Frequently Asked Questions

Got Questions? We've got answers!

Is Credit Repair legal?

Yes, credit repair is legal. We operate within the laws outlined in the Fair Credit Reporting Act (FCRA) and other regulations to ensure your rights are protected while helping improve your credit score.

Can I fix my credit on my own without professional help?

Absolutely! You can repair your credit on your own. However, it can be complex and time-consuming to navigate. Our professionals have the expertise and resources to address credit issues efficiently and effectively, saving you time and helping you achieve better results.

What actions hurt my credit?

Your credit can drop quickly, but you can protect it by avoiding these pitfalls:

- Not paying bills on time

- Filing for bankruptcy or foreclosure

- Applying for too many credit accounts

- Carrying high balances on your credit cards

- Ignoring questionable negative items on your report

How long does the credit repair process take?

The credit repair process varies depending on your unique situation, but most clients begin to see noticeable improvements within 35 to 90 days.

Credit Bureaus will investigate your dispute letters and will send you responses every 35 to 45 days. But the entire process might take 4 to 6 months, sometimes it may take longer than that depending on the result of the credit bureaus investigation. Please note that everyone’s case is different, no two people have the same things on their credit. We’ve seen people get results in one month while others graduate in 18 months.

We monitor this whole process and keep you informed on what you could do to speed up the process during this time frame. We have had clients gain up to 200+ points and all removals within the first 60 days, but those are not typical for everyone.

Does checking your credit score lower it?

No, if you will check your credit scores on your own like you request for your own credit report.

Yes, if you apply for a credit and the lender/creditor checks your credit scores for credit check. Either way, you'll see an “inquiry” on your credit report

Will deleted items go back on my credit report?

When an item has been deleted, occasionally, verification comes in later on behalf of the creditor. The Fair Credit Reporting Act recently modified its language to keep items from being re-reported on your report. Also, you must be informed before an item that was taken off before can be reported again. Once removed, it is quite unusual for a listing to show up again. If an item is re-reported, it is a simple matter to challenge the listing again and press for permanent deletion.